With great pleasure, we will explore the intriguing topic related to FSA Maximum Rollover 2025: What You Need to Know. Let’s weave interesting information and offer fresh perspectives to the readers.

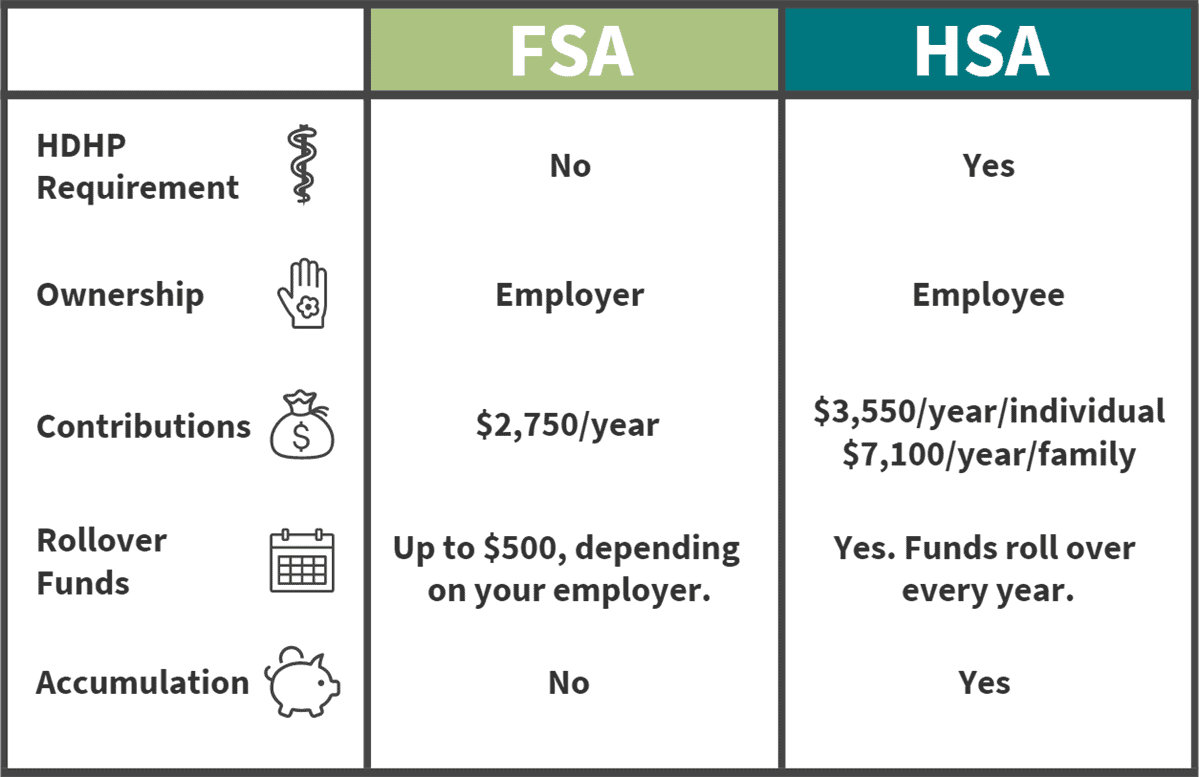

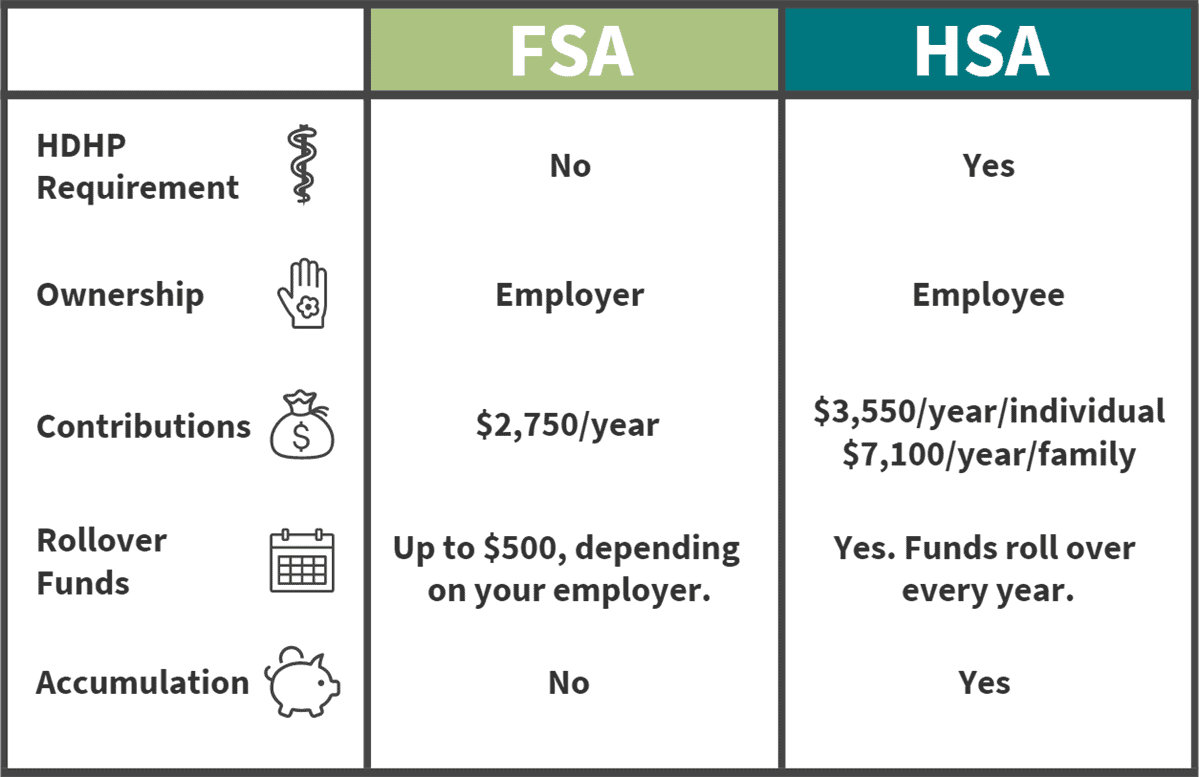

Flexible Spending Accounts (FSAs) are a popular employee benefit that allows individuals to set aside pre-tax dollars to pay for qualified medical expenses. In 2025, the maximum amount that can be contributed to an FSA will increase significantly. This article provides an overview of the FSA maximum rollover limit for 2025 and its implications for employers and employees.

The maximum amount that can be rolled over from an FSA to the following year will increase from $550 to $610 in 2025. This means that employees who have unused funds in their FSA at the end of the plan year will be able to carry over more money into the next year.

In addition to the increase in the FSA maximum rollover limit, the IRS has also announced the FSA contribution limits for 2025:

When considering the FSA maximum rollover limit for 2025, employers and employees should keep the following in mind:

The increase in the FSA maximum rollover limit for 2025 provides employers and employees with greater flexibility and savings opportunities. By understanding the implications of this change, employers and employees can optimize their FSA plans to meet their specific needs.

:max_bytes(150000):strip_icc()/Does-money-flexible-spending-account-fsa-roll-over_final-2a963663ba524f5e89bf25dca5f1422e.png)

:max_bytes(150000):strip_icc()/Does-money-flexible-spending-account-fsa-roll-over_final-2a963663ba524f5e89bf25dca5f1422e.png)

Thus, we hope this article has provided valuable insights into FSA Maximum Rollover 2025: What You Need to Know. We appreciate your attention to our article. See you in our next article!